Breakthrough Credit Repair

Our 100% Money Back Guarantee Is The Best In The Business If You Don't Get Results Then You Don't Pay. Period!

If We Are Not Able To Delete Negative Items From Your Credit Report And Increase Your Credit Score By At Least 100 Points Then You Don't Pay!

Click Below To Watch This Video First!

"Karl with Breakthrough Credit Repair Is The Real Deal. My Score Went Up In A few Months And Karl Got The Eviction Off My Report" -Krystal Ford

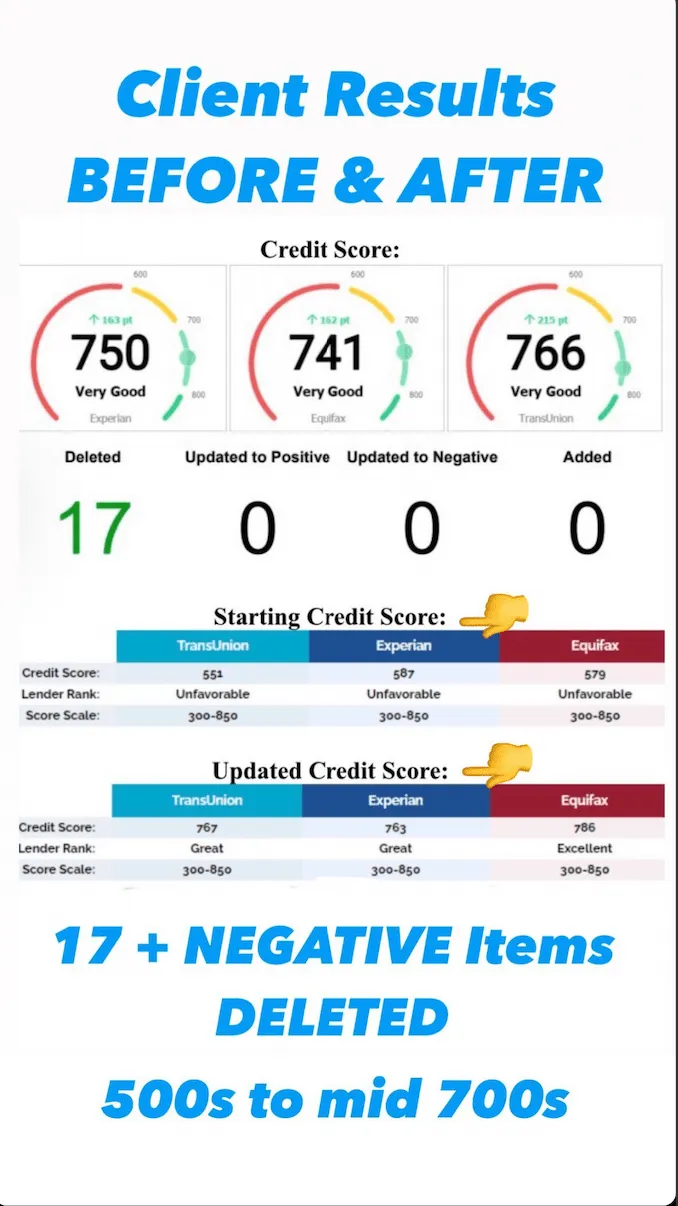

CHECK BELOW TO SEE SOME OF OUR MOST RECENT

SUCCESS STORIES

"Emma's Credit Score Increased 230 Points!"

"Daniel's Score Increased 125 Points!"

"Freddy Got Results Fast!"

"Thank's Tony we are happy for you!"

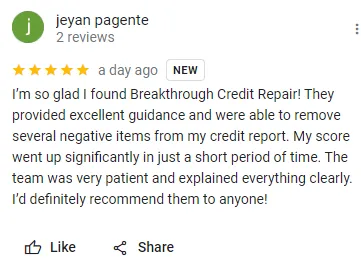

"Let's shoot for an 800 credit score jeyan!"

"thanks jeseca !"

WHY ARE WE

DIFFERENT?

With over 25 years of professional experience spanning multiple industries—real estate, mortgage brokerage, insurance, auto finance, property management, debt collection, and credit repair—I bring a level of expertise and insight to credit repair that is unmatched in the industry. My extensive background, combined with a flawless professional record of zero complaints across all my licenses, positions me to deliver the best possible outcomes for my clients. Whether you’re looking to purchase a home, qualify for a vehicle, secure a rental, or fight back against aggressive debt collectors, my unique skill set provides you with an unfair advantage in achieving your financial goals.

Why My Experience Matters for Your Credit Repair Journey

Real Estate & Mortgage Expertise: A Pathway to Homeownership:

As a licensed realtor and mortgage broker, I understand the intricate details of what lenders look for when approving a home loan. I don’t just repair your credit—I strategically improve your credit profile to meet the specific requirements of mortgage underwriters. From optimizing your credit utilization to addressing derogatory marks, I ensure your credit is in the best possible shape to secure the home of your dreams.

Auto Finance Knowledge:

Driving You Toward Better Car Loan Terms

Having worked as an auto finance manager, I know firsthand how credit scores impact loan approvals and interest rates. I’ll help you repair and rebuild your credit so you can qualify for the best possible terms on your next vehicle purchase, saving you thousands of dollars over the life of your loan.

Property Management Insight: Securing Your Next Rental:

As a former property manager, I understand the credit requirements landlords and property management companies use to screen tenants. I’ll help you address issues on your credit report that may be holding you back from securing the rental you desire, ensuring you present yourself as a reliable and qualified applicant.

Debt Collection Defense:

Standing Up to Aggressive Collectors my experience as a debt collector gives me insider knowledge of the tactics used by collection agencies. I know how to hold them accountable for unfair practices, dispute inaccurate claims, and negotiate settlements that work in your favor. You’ll have a fierce advocate on your side, ensuring your rights are protected under the Fair Debt Collection Practices Act (FDCPA).

A Proven Track Record of Integrity and Excellence:

In an industry often plagued by questionable practices, my 25+ years of holding professional licenses with zero complaints stand as a testament to my commitment to ethical, client-focused service. You can trust that I will always act in your best interest, providing transparent guidance and honest advice every step of the way. My reputation is built on delivering results while maintaining the highest standards of professionalism and integrity.

Your Financial Future Starts Here:

When you work with me, you’re not just getting a credit repair specialist—you’re gaining a trusted advisor with the knowledge and experience to help you achieve your financial goals. Whether you’re looking to buy a home, finance a car, secure a rental, or take control of your debt, I have the tools and expertise to make it happen. Let’s transform your credit and unlock the opportunities you deserve.

Are You Ready For Your Breakthrough?

"I was so embarrassed having such bad credit. Everyone was so understanding. Breakthrough credit hooked me up" - Mr. Bates

Credit Issues Out Of The Way Now Let's Buy A Home!

Experience Second To None

Certified Credit Repair Specialist

Comprehensive Credit Analysis: We will review your credit report, identify negative items, and create a personalized plan to improve your credit.

Dispute and Removal of Negative Items: Using laws like the Fair Credit Reporting Act (FCRA), (FDCPA), other Consumer Laws and Metro 2. We will dispute inaccurate or outdated information and work to remove negative marks such as collections, charge-offs, and bankruptcies.

Credit Profile Enhancement: Our specialists help you build positive credit habits and establish a stronger, more appealing credit profile.

Personalized Credit Improvement Strategies: You’ll receive tailored advice on managing credit utilization, adding positive accounts, and improving your score.

Ongoing Support: We offer ongoing education and guidance to ensure you maintain good credit in the long term.

Faster Results: With our expert knowledge, you can achieve better credit results more quickly.

Licensed Realtor

As Realtor I can review your financial situation and help you understand how your credit affects your ability to secure a mortgage. I can recommend steps to improve your score, making you a stronger candidate for loans.

Personalized Home Buying Strategy: Based on your credit standing, I can advise you on the best loan options including zero down payment loans and grants and low down payment loans available, and help you develop a timeline to improve your credit in preparation for purchasing a home.

Financial Guidance: I can provide ongoing support and resources to ensure you maintain good credit, helping you avoid common pitfalls that can affect your long-term financial goals.

Faster Path to Homeownership: With the combined expertise of a Realtor and credit repair specialist, you’ll be on a more efficient path to securing a mortgage and finding your dream home.

Former Mortgage Broker

Credit Review and Mortgage Readiness: I can assess your credit report, identify areas for improvement, and explain how your score impacts your ability to secure a loan.

Customized Credit Repair Plan: I can guide you through strategies to dispute negative items, improve your score, and enhance your credit profile to qualify for better loan terms.

Access to Specialized Loan Products: I have knowledge on a wide range of loan options.

Financial and Credit Counseling: I can provide advice on how to improve creditworthiness through responsible credit use, budgeting, and debt management in preparation for homeownership.

Faster Loan Approval Process: By improving your credit, you’ll not only qualify for better loans but also speed up the approval process, putting you on the fast track to securing a mortgage.

Former Auto Finance Manager

Credit Assessment for Auto Loans: I can review your credit and explain how it affects your loan eligibility, interest rates, and financing options.

Tailored Credit Repair Advice: I can guide you through steps to improve your credit score, such as disputing errors or resolving negative items, to help you qualify for better loan terms.

Access to Flexible Financing Options: With industry connections, I can help match you with lenders that work with individuals who have credit challenges, offering more favorable financing even with a lower score.

Loan Structuring: I can advise you on how to improve your overall credit profile, ensuring you can afford your vehicle and build credit.

Long-Term Credit Improvement: By improving your credit and securing an affordable loan, I can help you rebuild your financial profile, setting you up for better credit opportunities in the future.

Former Property Manager

Credit Assessment for Rental Approval: I can review your credit report to help you understand how it impacts your rental applications and suggest ways to improve your chances of approval.

Guidance on Removing Negative Rental History: If past evictions or rental-related collections are affecting your credit, I can guide you through the process of disputing or negotiating these items.

Connections to Credit Repair Resources: I can help you remove negative items, improve your score, and enhance your rental profile.

Help with Second-Chance Housing: I have access to landlords and properties that offer second-chance rental opportunities for individuals with credit challenges if you need to move immediately.

Ongoing Support: By maintaining a good rental history and improving your credit, we can help you position yourself for future financial success and better housing opportunities.

Former Debt Collector

Expertise in Combating Other Debt Collectors’ Tactics: With insider knowledge, I understands the strategies debt collectors use to pressure consumers. I can guide you on how to counteract aggressive collection tactics, such as constant calls or intimidation techniques, ensuring you handle them with confidence and within your rights.

Debt Validation and Dispute Assistance: I know the laws around debt validation and can help you demand proof of any debts claimed by other collectors. If a debt is not properly validated, I can assist in disputing it and removing it from your credit report.

Dealing with Harassment and Unlawful Collection Practices: I can identify illegal tactics used by debt collectors and assist you in filing complaints or taking legal action under the Fair Debt Collection Practices Act (FDCPA), potentially leading to removal of negative marks.

Understanding What Debt Collectors Can and Can’t Do: With my insider experience, I can educate you on your rights and explain exactly what debt collectors are allowed to do when collecting debts.

Knowing when a debt collector is bluffing or making empty threats.

Preventing wage garnishments or lawsuits when laws are not followed.

"Breakthrough Credit is the best!!"

"Karl fixed my credit and got me qualified for a ZERO Down Payment Mortgage " -Ricky Powell

"Breakthrough Credit was amazing and I highly recommend them to anyone who's interested in increasing their credit scores. Karl was able to get us qualified to buy a home in 6 months" - The Jones Family

"Finally Bought A Home!"

"Karl Helped us with our credit issues and we were able to purchase our first home" - Jon & Barbara Kleczynski

We Offer So Much More Than Disputing Negative Items

This Is Included In Our Credit Repair Service:

Removing Negative Items From Credit Report

Credit Education

Personalized Financial Coaching

Specialized Credit- Building Products

Mortgage Approval Program

Vehicle Approval Program

Rental Approval Program

Savings and Budgeting Education

Debt Collector Assistance

Identity Theft Protection

Credit Monitoring Services

Best Money Back Guarantee In The Business

Minimum 100+ Point Credit Score Boost

Breakthrough Credit Mobile App

24/7 Client Portal

IF YOU READ THIS FAR, HERE'S MY

INVITATION

Negative Items Will Be Removed From Your Credit Report And Your Score Will Increase By At Least 100 Points. If You Don't Get Results You Don't Pay That Is My Promise!

The President Of Breakthrough Credit Repair:

Karl (Herman) Moxley

Certified Credit Repair Specialist/Licensed Realtor/Former Mortgage Broker/Former Auto Finance Manager/Former Property Manager/Former Debt Collector

NOW THE MILLION DOLLAR QUESTION IS

ARE YOU IN?

The best time to plant a tree was 40 years ago. The second best time is today.

Now is the moment you finally fix your credit and start living the life you deserve. Are you ready for your Breakthrough?